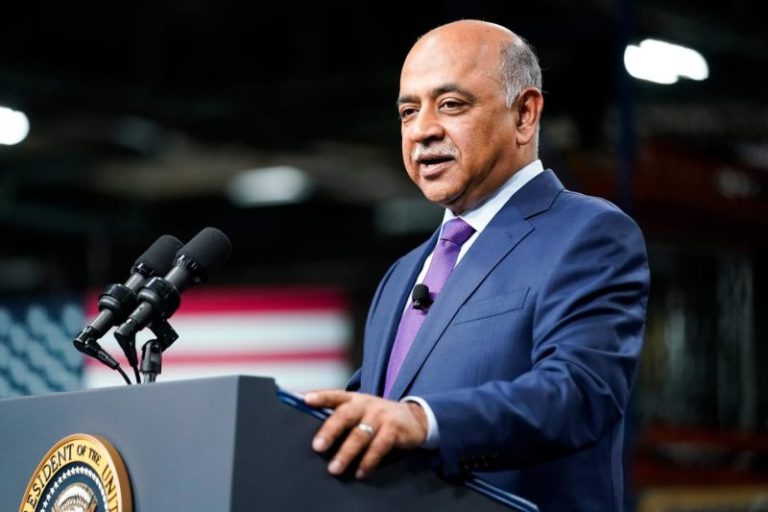

FPX Nickel Corp. (TSX-V: FPX) (OTCQB: FPOCF) (‘ FPX ‘ or the ‘ Company ‘) is pleased to announce the appointment of Dan Apai, P. Eng., as the Company’s Vice President, Projects effective May 1, 2025 . Mr. Apai succeeds Andrew Osterloh who will be departing his role as a Company employee on May 9, 2025 . Further, the Company is pleased to announce that Mr. Osterloh will be nominated for election as a Board member at the Company’s annual general meeting to be held on June 26, 2025 .

Martin Turenne , President and CEO of FPX stated, ‘On behalf of the Board of Directors, I would like to thank Andrew for his dedication and service to the Company. During Andrew’s tenure and under his leadership, the Company has significantly improved the development basis for the Baptiste Nickel Project, including progressing technical maturity in the areas of metallurgy, engineering, and execution planning. We are grateful for his efforts and wish him the very best going forward.’

Mr. Turenne continued, ‘I am delighted to welcome Dan to our senior management team. Dan has been a valuable contributor since he joined the Company in January 2023 as our Engineering Manager. Dan brings a wealth of knowledge from prior experience developing and commissioning multiple large-scale projects and his deep familiarity with Baptiste will ensure a smooth transition as we further advance the Project.’

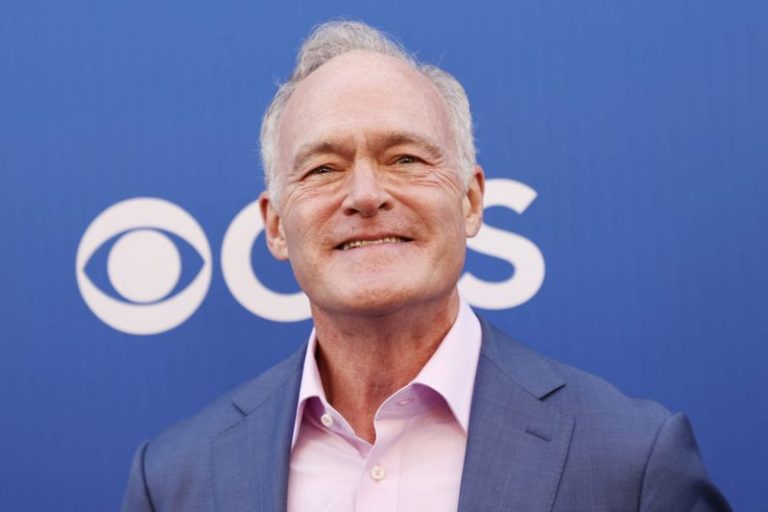

‘We are very happy to welcome Andrew to the FPX Board,’ commented the Company’s Chairman, Peter Bradshaw . ‘Andrew has demonstrated exceptional leadership in progressing Baptiste through the development of the prefeasibility and refinery studies. His deep understanding of the Project and strategic insights will be a significant asset to our Board. We look forward to his contributions as a Board member to the Company’s continued success.’

Mr. Osterloh joined FPX in June 2021 , bringing with him extensive experience from project management roles at Fluor Canada and site operations positions at several notable mining projects, including Eskay Creek (that is now being redeveloped by Skeena Gold & Silver) and Huckleberry, operated by Imperial Metals, both located in British Columbia . Mr. Osterloh will be assuming the role of VP, Engineering & Construction at Skeena Gold & Silver, as the Company undertakes redevelopment of the Eskay Creek Project.

Mr. Apai, the Company’s Engineering Manager since January 2023 , has over twenty years’ mining industry experience in civil engineering and engineering management over a diverse range of projects. As Principal Civil Engineer for Fluor Canada, he led study and detailed engineering works for numerous large-scale mining projects for clients including Teck, Newmont, BHP, First Quantum, Glencore, Josemaria Resources, and Newcrest. Dan’s technical expertise includes site layout, earthworks, water management, linear facilities (i.e., roads, powerlines, pipelines), and water supply systems – all elements that strongly influence the capital intensity, permitability, and operability of mining projects. Mr. Apai is a Member of the Association of Professional Engineers of British Columbia and holds a Bachelor of Engineering from the University of Western Australia .

About the Baptiste Nickel Project

The Company’s Baptiste Nickel Project represents a large-scale greenfield discovery of nickel mineralization in the form of a sulphur-free, nickel-iron mineral called awaruite (Ni 3 Fe) hosted in an ultramafic/ophiolite complex. The absence of sulphur and our ability to connect to the BC Hydro grid means that Baptiste has the potential to be one of the lowest carbon-intensive nickel producers in the world and will produce a very high grade product that does not required any intermediate smelting or complex refining. The Baptiste mineral claims cover an area of 453 km 2 west of Middle River and north of Trembleur Lake, in central British Columbia . In addition to the Baptiste Deposit itself, awaruite mineralization has been confirmed through drilling at several target areas within the same claims package, most notably at the Van Target which is located 6 km to the north of the Baptiste Deposit. Since 2010, approximately US$55 million has been spent on the exploration and development of Baptiste.

FPX has conducted mineral exploration activities to date subject to the conditions of agreements with First Nations and keyoh holders.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Baptiste Nickel Project, located in central British Columbia , and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite. For more information, please view the Company’s website at https://fpxnickel.com/ or contact Martin Turenne , President and CEO, at (604) 681-8600 or ceo@fpxnickel.com .

On behalf of FPX Nickel Corp.

‘Martin Turenne’

Martin Turenne , President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered ‘forward-looking information’ within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company’s periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE FPX Nickel Corp.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/April2025/29/c3955.html

News Provided by Canada Newswire via QuoteMedia